Are you planning a car-free holiday in Scotland? From picturesque fishing villages to historic castles, there’s no shortage of places to visit from Edinburgh by public transport.

Here are my favourite day trips from Edinburgh by train or bus. These fabulous destinations are easy to reach without a car and within a two-hour journey of the Scottish capital.

Some articles on this website contain affiliate links. This means that I may earn a small commission if you make a purchase through these links. As an Amazon Associate, I earn from qualifying purchases. Read the full disclosure here.

Best Day Trips from Edinburgh by Train or Bus

| DESTINATION | TYPICAL TRAVEL TIME |

| North Berwick | 30 minutes |

| Rosslyn Chapel | 50 minutes |

| St. Andrews | 90 minutes |

| Crail | 2 hours |

| South Queensferry | 30 minutes |

| Pitlochry | 1 hr 45 minutes |

| Dunfermline & Culross | 35 minutes (to Dunfermline) |

| Kelpies of Falkirk | 70 minutes |

| Arbroath | 90 minutes |

| Glasgow | 50 minutes |

| Loch Lomond | 50 minutes |

| Dundee | 80 minutes |

| Stirling | 40 minutes |

| Berwick-upon-Tweed | 50 minutes |

| Newcastle upon Tyne | 1 hr 40 minutes |

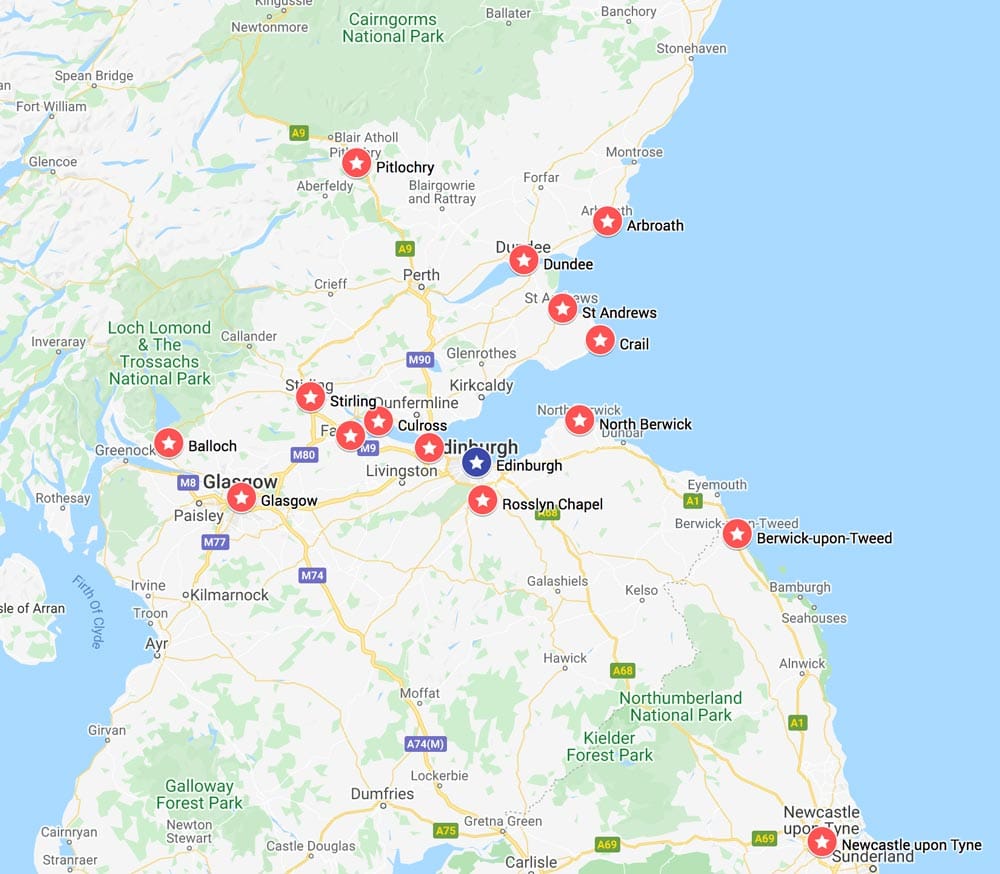

If you are someone who likes to picture where you are going, here is my map of these awesome day trips from Edinburgh by public transport. For an interactive map, click here or on the image itself.

North Berwick

To visit one of the 12 wildlife wonders of the world

The charming seaside town of North Berwick is one of the easiest day trips from Edinburgh by train. Not only does it have an eclectic range of shops & cafes, spectacular coastal scenery and a wide, sandy beach, it is also home to the Scottish Seaboard Centre.

On a clear day, you can see the Fife fishing villages of Anstruther and St. Monans across the Firth of Forth, and the evocative ruins of Tantallon Castle lie less than four miles to the east.

However, North Berwick’s greatest attractions lie 2 km off-shore. Described by Sir David Attenborough as one of the 12 wildlife wonders of the world, Bass Rock is home to Europe’s largest colony of northern gannets, numbering over 150,000 in the breeding season (March to October).

I love that they are loyal to the one patch of rock, returning there year after year to mate and raise their young.

From a distance, Bass Rock resembles a glistening iceberg. It’s not until you get closer that you realise the white sheen is due to bird droppings carpeting the volcanic rock underneath.

This uninhabited island also features ancient chapel ruins, a castle-turned-prison and a lighthouse designed by David Stephenson, cousin of Robert Louis Stephenson.

I visited on a boat trip operated by the Scottish Seaboard Centre, which included Craigleith, home to migrating cormorants, kittiwakes, guillemots, razorbills and the cutest of the bunch, puffins. A few basking seals also put in an appearance.

Getting from Edinburgh to North Berwick by train

Take a direct train from Edinburgh Waverley station. The average journey time is 33 minutes and there are around 16 trains per day. The Scottish Seaboard Centre is a 15-minute walk from North Berwick’s train station.

Rosslyn Chapel

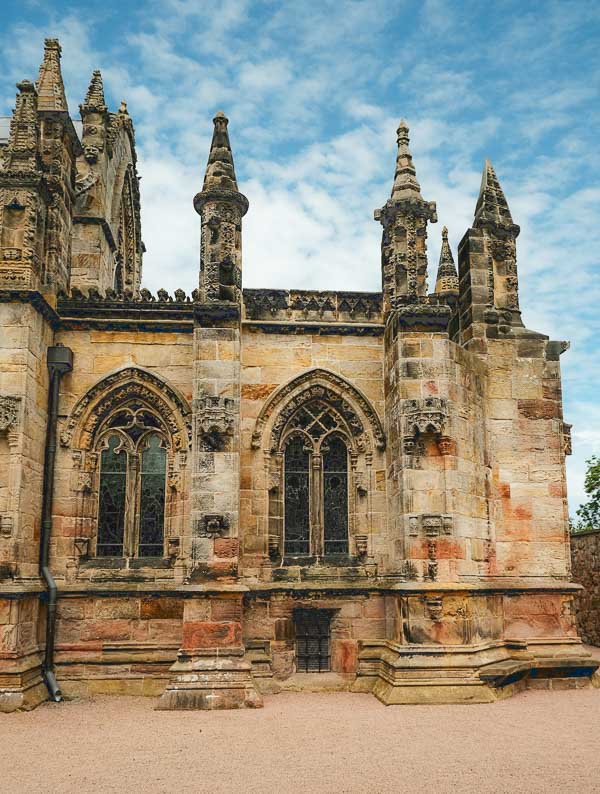

To explore a medieval masterpiece

Located just seven miles from Edinburgh, Rosslyn Chapel is famous for its sublime stone carvings, their mysterious symbolism and associated legends. In recent years, this 15th-century Gothic chapel has soared in popularity, thanks to its appearance in Dan Brown’s bestseller The Da Vinci Code.

Founded in 1446 by Sir William St. Clair, construction was halted after he died in 1449. Consequently, the chapel that we see today is far more modest in scale than originally intended.

Rosslyn Chapel is a thing of wonder, inside and out. Its exterior is adorned with pinnacles, gargoyles that act as water spouts and flying buttresses.

Inside, the chapel bursts with intricate stone carvings, including those of foliage and rich figurative sculptures. It is renowned for its multiple carvings of the Green Man, vines sprouting from the figure’s mouth, representing growth and fertility.

Many secrets lurk behind Rosslyn Chapel’s skilfully engraved stone and none are more compelling than that associated with the Apprentice Pillar.

This extraordinary knotted pillar is said to have been carved by an apprentice in the absence of the master stonemason, eclipsing his adjacent pillar. In a fit of wild jealousy, the master stonemason killed the apprentice and, according to legend, he then carved a tiny head of a man with a slashed forehead, said to be the ill-fated apprentice.

I recommend that you book tickets for Rosslyn Chapel in advance. Within your 90-minute time slot, you can view the chapel inside and out, visit the information centre and shop and use the café.

Information talks are offered by the Chapel’s Guides during each timeslot. These usually begin around 30 minutes after the start of the time slot and last for around 10-15 minutes.

Photography is not permitted inside the chapel.

When you have finished visiting Rosslyn Chapel, take a walk in Roslin Glen, just below the chapel. Choose one of the walking trails along the river and by the ruined castle. When it’s time for a pit stop, there’s an excellent pub and tea shop in the village.

Getting from Edinburgh to Rosslyn Chapel by bus

Catch the frequent 37 bus from Princes Street (direction Penicuik/ Deanburn) and alight at the Rosslyn Hotel. The journey takes between 40 and 60 minutes. More information here.

If you want to get the most out of your day trip and see the beautiful Scottish Borders, why not take a day trip with Rabbies? I have used this small company and their itineraries and guides are excellent.

>>> CLICK HERE FOR MORE INFORMATION & TO BOOK

St Andrews

For historic buildings and a sensational beach

Famous for its golf courses and the university where William met Kate, St. Andrews is another easy day trip from Edinburgh by train. Even if you are not a keen golfer, the main town of the ancient Kingdom of Fife is well worth visiting.

Maintaining its medieval layout – it has a hefty number of listed buildings – St. Andrews is compact and easy to walk around.

After exploring St. Andrews harbour and East Sands beach, make your way to the ruin of the once-mighty St. Andrews Cathedral. Consecrated in 1318, this shell was once the largest cathedral in Scotland, until it fell foul of the Reformation and supporters of John Knox.

Although there’s not much left to see of the 13th-century St Andrews Castle, it occupies a dramatic position, with a drop to the sea on two sides and a moat on the inland side. Also a victim of the Reformation, it was formerly the palace of the bishops and archbishops of St. Andrews.

Finish your time in St Andrews with a stroll along its magnificent West Sands beach. Famous for featuring in the opening scenes of the 1981 movie Chariots of Fire, this wide sandy beach, backed with dunes, extends for almost two miles.

Getting from Edinburgh to St. Andrews by train and bus

The fastest way to travel between Edinburgh and St. Andrews is to catch a train to Leuchars and then a bus to complete your journey. This journey should take you under 90 minutes including transfer time.

Alternatively, St. Andrews is a two-hour bus journey from Edinburgh. Catch the faster X59 or X59A Stagecoach service from Edinburgh bus station.

Crail

For a photogenic fishing village and coastal walks

Why not combine St. Andrews and Crail into one day trip from Edinburgh?

Crail is exceptionally photogenic, its cobbled streets winding their way down to the stone-built harbour, scattered lobster creels telling us that this is very much a working fishing village. If you time it right, you can tuck into the day’s catch from the wooden shack at the edge of the harbour.

Fishermen’s cottages are dwarfed by the grander merchants’ houses beyond the harbour and there’s even a 12th-century church where John Knox preached.

Do you fancy stretching your legs? Crail is also part of one of the most popular sections of the Fife Coastal Path, a 117-mile hiking trail that stretches from the Firth of Forth in the south to the Firth of Tay in the north.

Getting from Edinburgh to Crail by train and bus

Make your way from Edinburgh to St Andrews as before. From there, catch one of the hourly buses for the 30-minute journey to Crail.

South Queensferry

For a trio of iconic bridges

Just ten miles west of Edinburgh is the small town of South Queensferry.

It takes its name from Margaret, the wife of King Malcolm Calmore, who would use the ferry here to travel between the royal palaces in Edinburgh and Dunfermline. Most of the buildings lining its attractive cobbled high street date from the 17th and 18th centuries.

Today, South Queensferry is best known for its trio of iconic bridges across the Firth of Forth: the Forth Bridge, Forth Road Bridge and the Queensferry Crossing.

Built in the 1800s to transport rail passengers across the Forth Estuary, the mighty cantilevered Forth Rail Bridge is one of Scotland’s most famous landmarks and a UNESCO World Heritage site. The newest bridge of the bunch, the Queensferry Crossing, is the world’s longest cable-stayed bridge.

Getting from Edinburgh to South Queensferry by train

Take one of the frequent trains from Edinburgh Waverley to Dalmeny (15 minutes) from where it is a one-mile walk into town.

If you want to visit St. Andrews, the Forth Bridges and Anstruther (another charming Fife village) in one day, check out this day tour to St Andrews & the Fishing Villages of Fife with the excellent Rabbies.

Pitlochry

For a scenic train journey and whisky galore

From The Jacobite Steam train between Fort William and Mallaig to the mighty West Highland Line plied by the Caledonian Sleeper, Scotland is not short of iconic railway journeys. For one of the most scenic railway journeys from Edinburgh, and an opportunity to cross the iconic Forth Bridge, take the train north to Pitlochry.

Home to two excellent distilleries, this hillside town is a whisky lover’s dream. The best known is the Edradour Distillery, the smallest traditional distillery in Scotland. A lovely one-hour walk from Pitlochry through oak forests along the banks of the Black Spout burn will take you to Edradour Distillery. Alternatively, it’s a 10-minute taxi ride.

Set in open moorland south of the town centre is Blair Athol Distillery, one of Scotland’s oldest working distilleries. Founded in 1798, its location at the foot of the Grampian mountains was chosen for its constant supply of pure water from the ancient Allt Dour.

If they are not enough, Robertson’s of Pitlochry has an excellent selection of rare and unique whiskies from across the globe as well as other spirits. It also hosts regular tastings and events.

Pitlochry also has a hydroelectric dam. A short walk upstream will bring you to Pitlochry Power Station and Dam and its visitor centre. One of the more unusual features of this dam is the salmon ladder, which allows the fish to make their way upstream past the dam.

Getting from Edinburgh to Pitlochry by train

The fastest journey time from Edinburgh to Pitlochry is 1 hour 45 minutes. Check train times as there are only around eight services a day and some journey times are significantly longer.

Dunfermline & Culross

For history buffs (and Outlander fans)

Head to the historic Kingdom of Fife for two destinations for the price of one.

Start in Dunfermline, the former de facto capital of Scotland, established by Malcolm III in the 11th Century. Visit the magnificent Dunfermline Abbey, the final resting place of Robert the Bruce who helped to rebuild the abbey in the wake of the War of Independence.

From Dunfermline, catch a bus to Culross, considered Scotland’s most complete example of a burgh of the 17th and 18th centuries. This picturesque village is home to historic buildings, including white-harled houses with red-tiled roofs and an ochre-coloured palace with a reconstructed period garden.

Culross found fame as one of the Outlander filming locations, doubling as the fictional village of Cranesmuir.

Getting from Edinburgh to Culross by train and bus

There is no direct public transport service to Culross. Catch a train to Dunfermline and then change to the local bus service to complete your journey (8, 8a, 8b).

Kelpies of Falkirk

To view iconic equine sculptures

Now for something completely different.

On the face of it, Falkirk might seem an unlikely contender for a day trip from Edinburgh. But the arrival of the Kelpies in 2014 has put this industrial town firmly on the map.

This pair of head-turning 100-foot-tall horse sculptures, crafted from glistening steel, is a tribute to the horses that played a pivotal role in Scotland’s industrial past. They are quite a sight if you are driving along the adjacent motorway!

Created by the artist Andy Scott, the Kelpies attract tourists from across the globe. Take a Kelpie Tour to get inside a Kelpie and learn about its history and the vision behind the creation of these sculptures.

The Kelpies are housed in The Helix, a parkland with around 500km of cycle paths, walking, watersports and a visitor centre.

Getting from Edinburgh to The Kelpies of Falkirk by train and bus

To get to the Kelpies and Helix Park take the train to Falkirk Grahamston (located 2 miles away). The journey time is just over 40 minutes. Buses toward The Kelpies leave every 10 minutes from nearby Weir Street and take 30 minutes to get there.

Arbroath

To feast on fresh smokies

Much like haggis or cullen skink, Arbroath Smokies are a quintessential Scottish culinary experience. This delicacy of line-caught haddock smoked over oak chips has been produced by family-run smokehouses around the harbour since the late 1800s.

As they have PGI status, Arbroath Smokies can only be produced within a five-mile radius of the town centre. Although you can eat these elsewhere in Scotland, you can’t beat the sweet flavour of warm, fresh smokies straight from the smokehouse.

But there’s more to Arbroath than smokies. It has an attractive working harbour and is home to the pink sandstone ruins of Arbroath Abbey, best known for the Declaration of Arbroath in 1320.

By the harbour, there’s the Signal House Museum which offers an insight into local history and tells the story of the Bell Rock Lighthouse, Britain’s oldest surviving offshore lighthouse. Designed by the famous engineer, Robert Stevenson, the lighthouse sits on a reef eleven miles offshore.

Getting from Edinburgh to Arbroath by train

The average train journey from Edinburgh to Arbroath is just over two hours, although fast trains can make it in under 90 minutes.

Glasgow

To visit Scotland’s second city

If you’d like to sneak a peek at Scotland’s largest city, Glasgow is a super easy day trip from Edinburgh.

Less touristy than its rival to the east, Glasgow is known for its friendly residents with unfathomable accents, Charles Rennie Mackintosh, thriving cultural scene, awesome street art and excellent vintage stores.

There’s enough to keep you busy in Glasgow for a week or more, and what you choose to do will depend on your tastes and interests.

When I visited, I made a beeline for The Lighthouse, Scotland’s Centre for Design and Architecture, housed in the former offices of the Glasgow Herald newspaper. This building was designed by Charles Rennie Mackintosh and offers an insight into his architectural heritage.

Visit The People’s Palace in historic Glasgow Green, the oldest public space in Glasgow, for a fascinating journey through the city’s social history from 1750 to the present day.

If vintage shopping is more your thing, head to Mr Ben Retro Clothing in Glasgow’s Merchant City. This has gained a reputation as one of Scotland’s most well-stocked vintage stores.

Getting from Edinburgh to Glasgow by train

Trains depart from Edinburgh to Glasgow Queen Street station every 15 minutes and take around 50 minutes. More frequent services which take longer go between Edinburgh and Glasgow Central station.

Loch Lomond

For loch and mountain views

Why finish your day trip at Glasgow? From Queen Street station, it’s a short train journey to Balloch, one of the major gateways to the bonnie shores of Loch Lomond.

Covering over 700 miles of scenic territory, Loch Lomond & the Trossachs National Park comprises soaring mountains, forests, lochs and villages. The star of the show is Loch Lomond, the largest inland body of water by surface area in the UK.

From Balloch, the best thing to do is to cruise on Loch Lomond and explore Balloch Castle Country Park, with its shoreside and forest walks.

Getting from Edinburgh to Loch Lomond by train

Make your way from Edinburgh to Glasgow as before and then catch a train from Glasgow Queen Street Station. The journey time is around 50 minutes.

If you are short on time, why not combine Loch Lomond with the Kelpies and Stirling Castle by booking this day tour with Rabbies?

Dundee

A day trip for culture vultures

Although I stayed across the River Tay from Dundee on my last visit to Scotland, this city is an easy day trip by train from Edinburgh.

Traditionally Dundee has been famous for its three j’s. Jute (the city was Britain’s main processor); journalism (home of D.C. Thomson); and jam (marmalade was made here for the first time in the late 1700s).

Whilst these have all but disappeared, you won’t have to look hard to fund statues and murals celebrating Beano and Dandy icons, including Desperate Dan, Dennis the Menace and Minnie the Minx.

Today, the city is starting to shake off its drab reputation and is reinventing itself as one of Scotland’s most important cultural hubs. The star of its renaissance is the V&A Dundee, whose design collection is housed in a striking curvy building jutting towards the River Tay.

Adjacent to the V&A is the RSS Discovery which carried Robert Falcon Scott and Ernest Shackleton on their first journey to the Antarctic. She is the centrepiece of Discovery Point, which tells the story of her Antarctic expedition with Captain Scott and her voyages and uses thereafter.

Hike up to Dundee Law for a panoramic view of the city, the river and beyond. At 571 feet, this plug of an extinct volcano is the city’s highest point. The spectacular bridges across the River Tay – the Tay Road Bridge and Tay Rail Bridge – also offer a sweeping view of the city.

Finally, Dundee is also reputed to be Scotland’s sunniest city!

Getting from Edinburgh to Dundee by train

The frequent direct train service between Edinburgh Waverley and Dundee takes an average of 1 hour 21 minutes.

Stirling

For a potent dose of Scottish history

For an ancient hilltop castle, a national hero and a historic battlefield, take a day trip from Edinburgh to Stirling.

Dominating the city’s skyline, Stirling Castle was one of Scotland’s largest and most important castles, home to Scottish royalty between the 15th and 17th centuries. It was here that the coronation of Mary Queen of Scots took place (and where she almost burnt to death in her bed).

Nearby is the lofty National Wallace Monument, a Victorian monolith constructed to commemorate William Wallace. Famously portrayed by Mel Gibson in the 1995 film Braveheart, Wallace was a Scottish hero who fought alongside Robert the Bruce.

It was in Stirling in 1297 that William Wallace led the Scots to victory over the English at the Battle of Stirling Bridge. Seventeen years later, Robert the Bruce’s army crushed the English again at the Battle of Bannockburn. Learn more about this great victory at the Battle of Bannockburn Visitor Centre and 3D Experience.

Getting from Edinburgh to Stirling by train

The frequent direct train service between Edinburgh Waverley and Stirling takes 40 minutes.

Berwick-upon-Tweed

To walk along England’s greatest ramparts

Just four kilometres from the Scottish border is the historic town of Berwick-upon-Tweed. Due to its location, it was at the centre of a tug-of-war between Scotland and England for 300 years before the future King Richard III finally claimed it for England in 1482.

From the town’s train station, it’s a short distance to its Elizabethan ramparts, built between 1558 and 1570 to keep the invading Scots at bay. Start your day in Berwick with a walk along these grey limestone ramparts, the most intact defensive walls in the UK at just over a mile in length.

Take a riverside stroll to one of Britain’s most iconic bridges: the Royal Border Bridge. Designed by Robert Stephenson, this Victorian viaduct was the last link in the railway line linking London to Edinburgh.

LS Lowry immortalised Berwick-upon-Tweed town on canvas over a 40-year period. If you are up for a longer walk, an easy six-mile waymarked Lowry Trail with 18 information boards providing information on the Lowry painting associated with that location.

Another rewarding walk is to Berwick’s lighthouse at the end of a pier jutting out into the mouth of the River Tweed. You’ll be rewarded with sweeping views along the coast and, if you’re lucky, you’ll spot seals or even a school of dolphins.

Getting from Edinburgh to Berwick-upon-Tweed by train

The frequent direct train service between Edinburgh Waverley and Berwick-upon-Tweed takes an average of 47 minutes.

Newcastle upon Tyne

To visit one of England’s most vibrant cities

Newcastle upon Tyne, the vibrant jewel of northeast England, is another easy train journey from Edinburgh.

Get to know the city by taking a self-guided walking tour of Newcastle. This starts at the train station and finishes at the Gateshead Millennium Bridge. If you hoof it, you can complete its 4km length in one hour. However, I recommend a more leisurely pace, taking time to see Newcastle’s landmarks along the way.

Although Newcastle has a wonderful Georgian city centre, its waterfront draws the crowds, particularly its four iconic bridges: High Level Bridge, Swing Bridge, Tyne Bridge and the Gateshead Millennium Bridge. The riverfront is also home to two of the city’s cultural giants: The Glasshouse International Centre for Music and the BALTIC Centre for Contemporary Art.

Getting from Edinburgh to Newcastle upon Tyne by train

The frequent direct train service between Edinburgh Waverley and Newcastle upon Tyne takes an average of 1 hour 36 minutes.

Tips for Planning Your Car-Free Day Trip from Edinburgh

I hope this has given you the inspiration and information to take fabulous day trips by public transport from Edinburgh. But before I wind up this article, here are some practical tips to help you plan the perfect day out.

1. Beware of inclement weather

It’s not unusual for it to rain in Scotland. I’m not saying bad weather should stop you from exploring; you just need to be prepared. It goes without saying you should pack raingear and appropriate footwear to deal with any downpours.

Try to plan activities according to the weather forecast. Whilst places like Glasgow and Stirling have rainy day activities, sailing on Loch Lomond won’t be much fun if it’s pelting down.

2. Check train and bus timetables

Most of the services between Edinburgh and these destinations are frequent. However, there are a handful that are not so frequent. It pays to check train and bus times in advance, particularly if you want to visit more than one place in one day.

3. Central Edinburgh has two train stations

You’ll most likely use Waverley Station from where most trains arrive and depart. Haymarket Station handles commuter train traffic.

4. Edinburgh also has several bus stations

Although Edinburgh has several bus stations, services from most bus companies start and finish their journeys at the Edinburgh Bus Station (also known as St. Andrews Bus Station) on Elder Street.

5. Choose your accommodation wisely

If you plan to take a few day trips by bus or train from Edinburgh, I recommend choosing accommodation within walking distance of the train or bus. I stayed at the Hub by Premier Inn, a mid-range hotel on Rose Street, a ten-minute walk from Waverley Station.

6. Leave enough time to explore Auld Reekie

Last but not least, leave enough time to make the most of Edinburgh itself. It’s a charming city with lots to see and do.

Solo Travel in Scotland

Scotland is one of the best solo travel destinations in the world, especially if you are a first-time single traveller.

From its lush rolling hills and mirror-like lakes to its blindingly white beaches, Scotland is home to some of the most striking and diverse landscapes to be found anywhere. It’s a walker’s and photographer’s paradise.

Scotland is relatively safe, the locals are very friendly and speak English. There is a wide variety of accommodation, from a thriving hostel scene and cosy bed & breakfasts to boutique and castle hotels.

It’s easy to get around. Whilst driving is the easiest way to explore Scotland, this is not for the faint-hearted. Some roads in the Highlands and Islands are single lanes punctuated with passing places that you can pull into if necessary.

However, each time I have visited Scotland I have used public transport and day tours. Scotland’s major towns and cities are linked by train and bus (Scottish Citylink runs long-distance express coach services).

Thank you for reading my guide to day trips from Edinburgh by public transport

I hope that the sun shines and you have a wonderful time. If you have found it helpful, take a look at some of my Scotland articles:

- Best Things to Do in Fort William & Beyond: 3-Day Itinerary (Without a Car)

- The Best Things to Do in Inverness, Scotland & Beyond

- 14 Amazing Things to Do in Oban, Scotland in Two Days

- 7 Best Things to Do in Inveraray, Scotland

- 8 Best Things to Do in Tobermory, Mull

- The Best Day Trip from Fort William to Glencoe (Even Without a Car!)

About Bridget

Bridget Coleman has been a passionate traveller for more than 30 years. She has visited 70+ countries, most as a solo traveller.

Articles on this site reflect her first-hand experiences.

To get in touch, email her at hello@theflashpacker.net or follow her on social media.